From November 2022 onwards, 3.4 million KE bills have been resized to A5 from A4, while there are no changes to the details of your monthly power consumption. Reducing the size of our bill to half its half its former size halves the environmental footprint and prevents 92 tonnes of paper-based waste from entering Karachi’s landfills, preserves 4200 trees and saves 265 million liters of water annually.

- Preserving 4200 trees and off-setting 94 tonnes of CO2

- Saving 265 million liters of water

- Preventing 92 tonnes of paper-based waste from entering Karachi’s landfills

Our “Hara Qadam” halves the environmental footprint of KE’s bills and sets a precedent for industry players to follow.

While our Hara Qadam initiative halves the environmental footprint of paper bills, we invite you to take the next step in environmental sustainability by subscribing to e-billing HERE

- Preserving 4200 trees and off-setting 94 tonnes of CO2

- Saving 265 million liters of water

- Preventing 92 tonnes of paper-based waste from entering Karachi’s landfills

Fuel Charge Adjustment Relief announced by the Prime Minister on 3rd September 2022

Please note that Non-ToU Residential customers with consumption above 300 units, ToU Residential, Industrial, Commercial, and other categories (except Agriculture) are not eligible for this Fuel Charge Adjustment relief. As such these customers are reminded to pay bills by due date to avoid Late Payment Surcharge

- Eligible Customers don’t need to visit the Customer Care Centre, all revised bills of eligible customer will be delivered to them on their registered address.

- Customers who’ve already paid their August bills will receive an adjustment in their September bills.

- Any non-issued bills will be revised and dispatched to eligible customers.

Customers who’ve already paid their August bills will receive an adjustment in their September bills.

Sample calculation of relief provided to Non -Protected customers in August electricity bills is:

| ACTUAL FCA | |||

|---|---|---|---|

| FCA MONTH | Units | Rate | Amount |

| May-22 | 210 | 6.8858 | 1,446.02 |

| Jun-22 | 250 | 3.0114 | 752.85 |

| 2,198.87 | |||

| REVISED FCA | |||

|---|---|---|---|

| Units | Rate | Amount | |

| 210 | 0 | 0 | |

| 250 | 0 | 0 | |

| 0 | |||

Fuel Charge Adjustment Relief announced by the Prime Minister on 22nd August 2022

- Agricultural customers

- Residential Non-ToU customers whose electricity consumption was up to 200 units in June only across Pakistan.

Please note that Non-ToU Residential customers with consumption above 200 units, ToU Residential, Industrial, Commercial and other categories (except Agriculture) are not eligible for this Fuel Charge Adjustment relief. As such these customers are reminded to pay bills by due date to avoid Late Payment Surcharge

- Non-ToU Domestic (Protected) consumers having ≤ 200 units consumption would only pay Rs. 3.8972/Unit FCA in August 2022 billing month.

- Non-ToU Domestic (Non-Protected) consumers having ≤ 200 units consumption and Private Agriculture consumers shall not pay any FCA in August 2022 billing month.

Protected customers are those Non-ToU residential consumers who have consumed up to 200 units/month consistently for past 6 months. All other Non-ToU Residential customers are Un-Protected.

All other Non-ToU Residential customers (with sanctioned load below 5 kW) who don’t fall under the protected category would be categorized as Unprotected Customers as per the Tariff Terms & Conditions.

- Customers who’ve received bills & are yet to pay should visit the Customer Care Centre for their revised bills from 26th August 2022 onwards. Customer Care Centre timings have been extended to facilitate in this regard.

- Customers who’ve already paid their August bills will receive an adjustment in their September bills.

- Any non-issued bills will be revised and dispatched to eligible customers.

| Friday 26th August: | 9:00 AM – 8:00 PM (Namaz Break : 1:00 – 3:00 pm) |

| Saturday 27th August: | 9:00 AM – 8:00 PM |

| Sunday 28th August: | 9:00 AM – 5:00 PM |

Sample calculation of relief provided to Protected customers in August electricity bills is:

| ACTUAL FCA | |||

|---|---|---|---|

| FCA MONTH | Units | Rate | Amount |

| May-22 | 200 | 6.8858 | 1377.16 |

| Jun-22 | 120 | 3.0114 | 361.37 |

| 9.8972 | 1738.53 | ||

| REVISED FCA | |||

|---|---|---|---|

| Units | Rate | Amount | |

| 200 | 2.7543 | 550.86 | |

| 120 | 1.2046 | 144.55 | |

| 3.95888 | 695.41 | ||

Sample calculation of relief provided to Non-Protected customers in August electricity bills is:

| ACTUAL FCA | |||

|---|---|---|---|

| FCA MONTH | Units | Rate | Amount |

| May-22 | 200 | 6.8858 | 1377.16 |

| Jun-22 | 120 | 3.0114 | 361.37 |

| 9.8972 | 1738.53 | ||

| REVISED FCA | |||

|---|---|---|---|

| Units | Rate | Amount | |

| 200 | 0.0000 | 0.0000 | |

| 120 | 0.0000 | 0.0000 | |

| 0.0000 | 0.0000 | ||

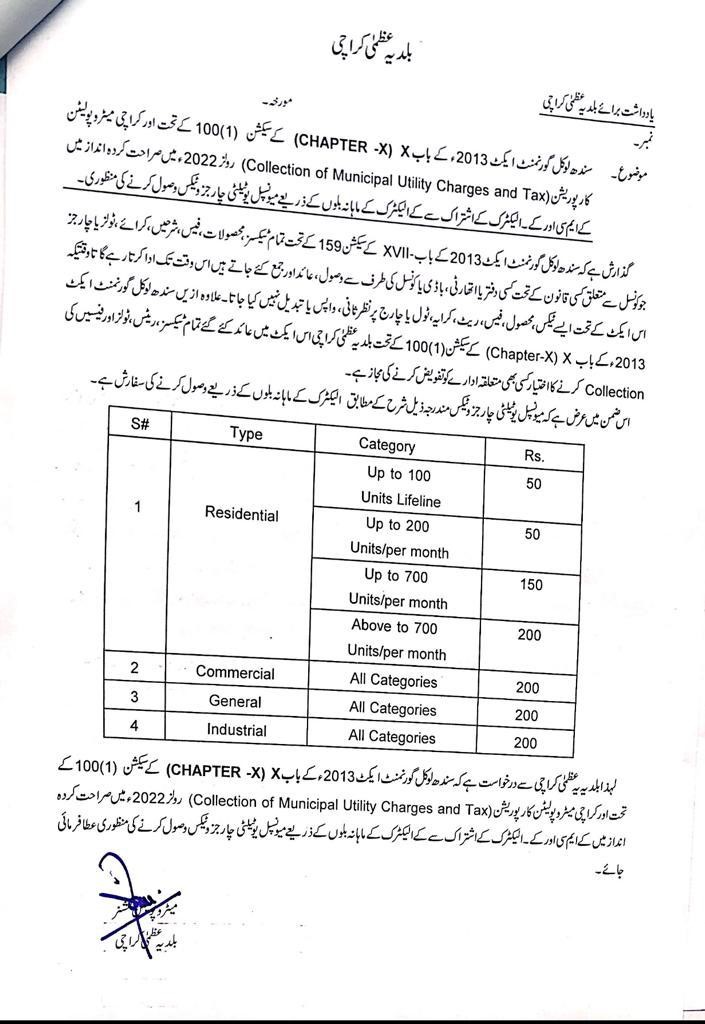

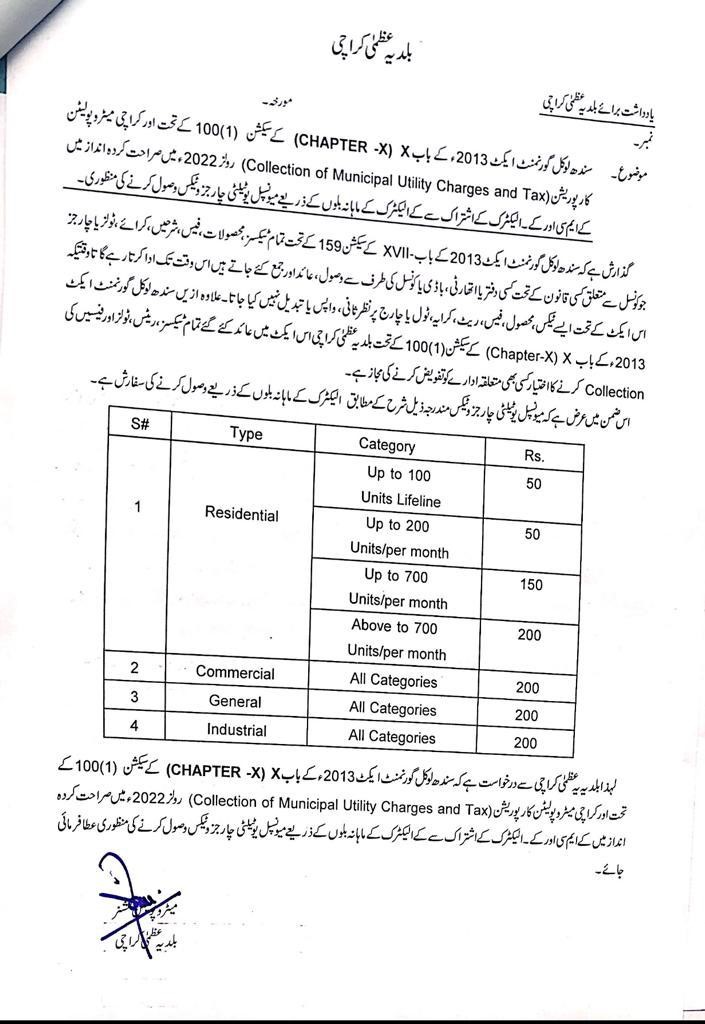

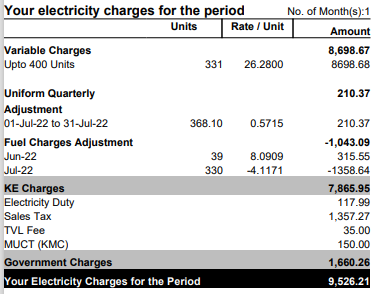

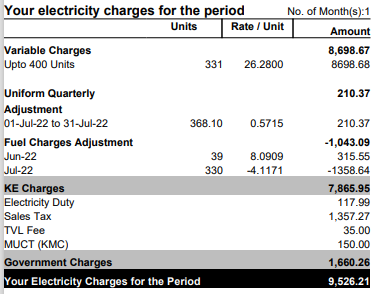

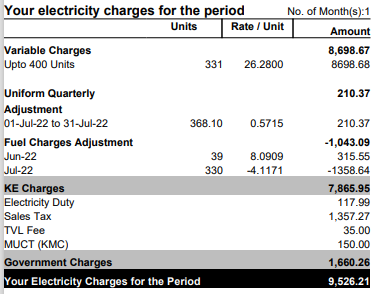

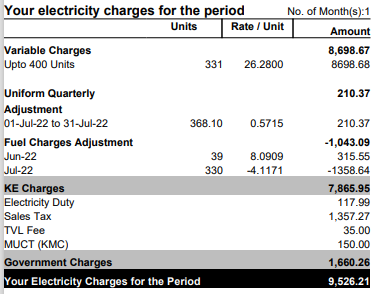

As per notifications passed by Government of Sindh, Municipal Utility Charges and Taxes (MUCT) is applicable on all connections in the city (except cantonment areas).

KMC has appointed KE as its collecting agent of MUCT on behalf of KMC through monthly electricity bills as per the notifications issued by the Government of Sindh under Section[s] 96, 100 and 138 of the Sindh Local Government Act 2013 and Karachi Metropolitan Corporation [Collection of Municipality Utility Charges and Taxes] Rules 2022 as notified by the Government of Sindh.

MUCT will be applicable on all consumers specified hereinabove from Sep 2022 and onward billing.

Please note that all taxes collected by K-Electric through electricity bills are deposited with the Federal and Provincial Governments accordingly and are outside purview of KE. KE only acts as a collecting agent of taxes/duties on behalf of the Federal and Provincial Government.

The Karachi Metropolitan Corporation has issued resolution/notification specifying rates and consumers/connections as below.

| S. # | Type | Category | Rs. |

|---|---|---|---|

| 1 | Residential | Upto 200 Units | 50 |

| Upto 700 Units /month | 150 | ||

| Above to 700 Units/ month | 200 | ||

| 2 | Commercial | All Categories | 200 |

| 3 | General | All Categories | 200 |

| 4 | Industrial | All Categories | 200 |

This tax is applicable on all connections across Karachi except cantonment areas of the city. Parts of KE’s licensed territory beyond Karachi’s jurisdiction i.e. Hub , Uthal and Gharo are also exempted from this tax.

Agriculture, Street Lights, Bulk Supply consumers are exempted.

Agriculture: Consumers predominantly engaged in agriculture activities by using land for the production or raising of crops, poultry, or livestock.

Streetlight: supply for the purpose of illuminating public lamps.

Bulk Supply: Supply given at one point for self-consumption not selling any other consumer such as residential, commercial, tube-well and others.

MUCT will be applicable on the bills of Sep 2022 and onward.

Please note that the address on the invoice of the relevant document should match the address on KE bill.

Please note that the decision to levy or remove taxes is outside of KE’s domain. KE will fully comply with Honourable Court’s final verdict on MUCT when received and any electricity bills paid inclusive of MUCT amount will be addressed accordingly.

* vide order dated 26.09.2022 in C.P No. 2724/2022

We remind our valued customers to pay their electricity bills within their due dates. KE will fully comply with Honourable Court’s final verdict on MUCT when received and any electricity bills paid inclusive of MUCT amount will be addressed accordingly.

* vide order dated 26.09.2022 in C.P No. 2724/2022

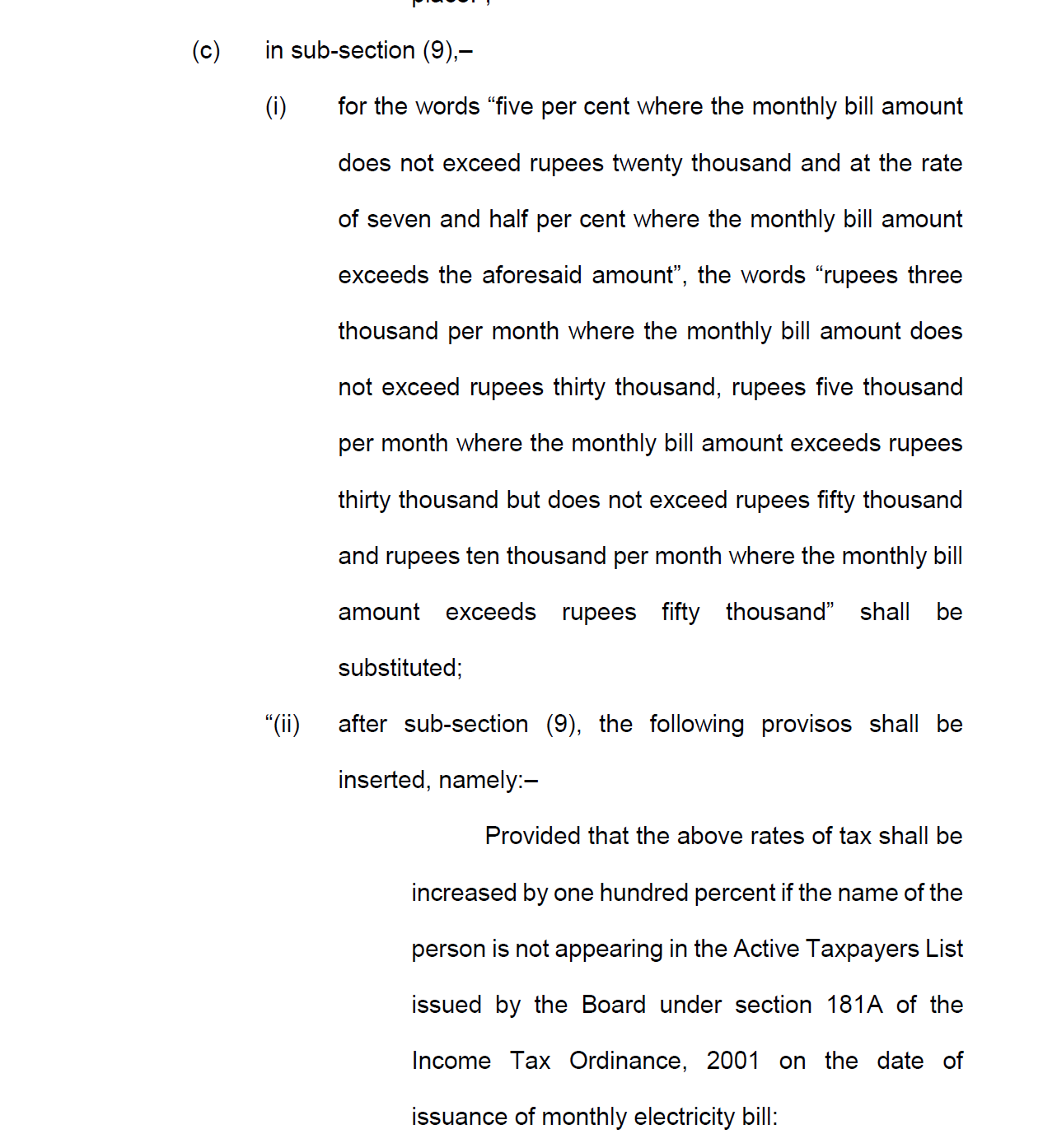

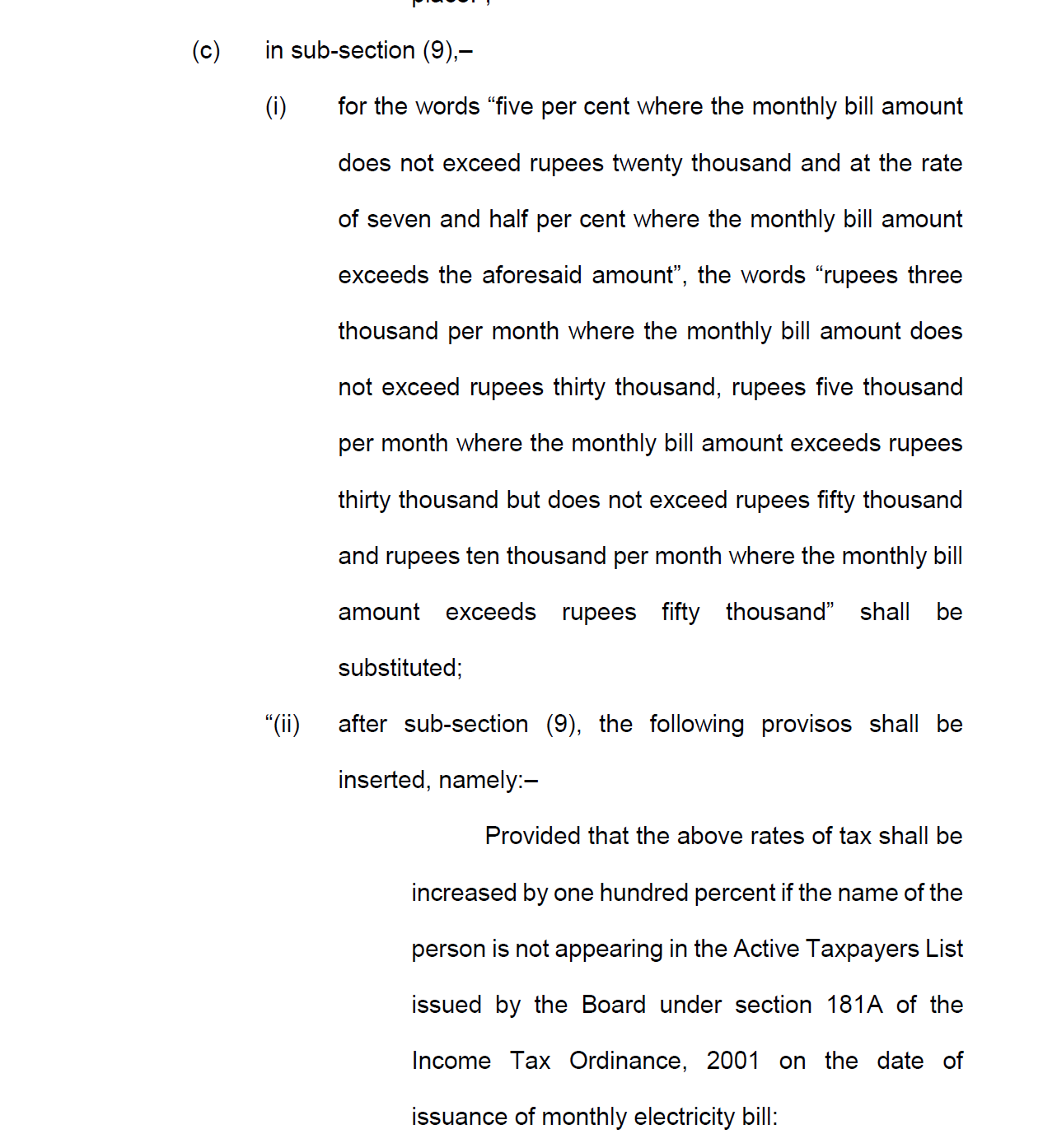

Sales Tax on Retailers effective 1st August

Per Finance Act, 2022 the Federal Government revised the applicable Sales Tax on Retailers with effect from 01st July 2022. Thus, electricity bills for July were charged Sales Tax according to the following slabs.

| Amount of Monthly Bill (PKR) | Sales tax on Unregistered Retailers (PKR) | |

|---|---|---|

| Active Taxpayer* | Inactive Taxpayer* | |

| 0 – 30,000 | 3,000 | 6,000 |

| 30,001 to 50,000 | 5,000 | 10,000 |

| Above 50,000 | 10,000 | 20,000 |

In line with the recent announcement by the Ministry of Finance & Revenue for the reversal of the Fixed Sales Tax Scheme, Sales Tax on Retailers has been revised w.e.f. 1 July 2022 to the mechanism followed before Finance Act 2022. Please note that this is subject to necessary legislation.

In line with the minutes of meeting issued by the Federal Board of Revenue (FBR) dated August 05, 2022, upcoming bills will be issued with Sales Tax amount on Retailers per the below rates as were applicable prior to Finance, Act, 2022:

| Amount of Monthly Bill (PKR) | Rate of Sales Tax on Retailers |

|---|---|

| Up to 20,000 | 5% |

| Above 20,001 | 7.5% |

Please note: KE is revising the bills for July 2022 and is issuing the bills for August 2022 in the light of the announcement speech of Finance Minister and FBR minutes of meetings dated August 05, 2022. Therefore, KE has reserved the right to further revise these bills if required in the light of the amendments in the sales tax law which we expect to be issued by the Federal Government in due course. Please note that K-Electric only acts as a collecting agent on behalf of the Federal and Provincial Governments and that taxes collected through electricity bills are deposited with them and are outside of KE purview.

In line with the recent announcement by the Ministry of Finance & Revenue for the reversal of the Fixed Sales Tax Scheme, Sales Tax on Retailers has been revised w.e.f. 1 July 2022 to the mechanism followed before Finance Act 2022.

If you have already paid your July 2022 bill

Don’t worry if you have already paid sales tax through your July 2022 electricity bill Per Finance Act, 2022

Sales Tax on Retailers for both July and August will be calculated/re-adjusted per the mechanism followed prior to amendments made through Finance Act 2022 (subject to necessary legislation). Any amount paid in July 2022 over and above this calculation, will be adjusted against your August Energy Charges and you will only have to pay the differential amounts. To understand how the charges will be calculated, please see the example below:

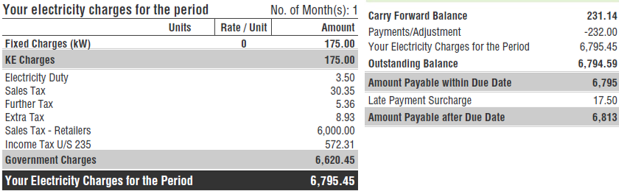

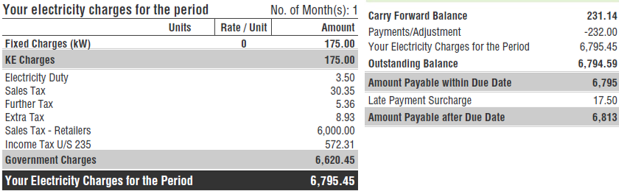

JUL-22:

AUG-22:

Calculation:

| Bill of July-22 (Per Finance Act 2022) | Bill of July-22 (Revised to Methodology Prior Finance Act 2022) | ||

|---|---|---|---|

| Current month consumption (Variable Charges) | 175 | Current month consumption (Variable Charges) | 175 |

| Electricity Duty (2%) | 4 | Electricity Duty (2%) | 4 |

| Sales Tax (17%) | 30 | Sales Tax (17%) | 30 |

| GST Further (3%) | 5 | GST Further (3%) | 5 |

| Extra Tax (5%) | 9 | Extra Tax (5%) | 9 |

| Sales Tax – Retailers | 6,000 | Sales Tax – Retailers (5%) | 9 |

| Income Tax U/S 235 | 572 | Income Tax U/S 235 | – |

| Total Electricity Charges for the month | 6,795 | Total Electricity Charges for the month | 232 |

| Difference | (6,563) | ||

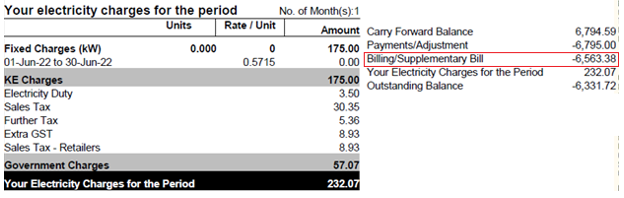

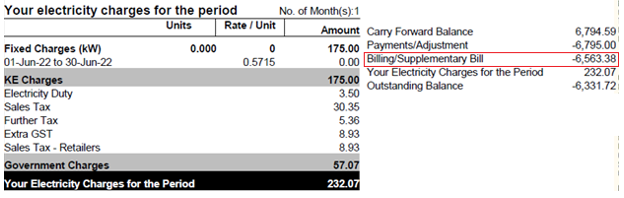

If I haven’t paid your July 2022 bill

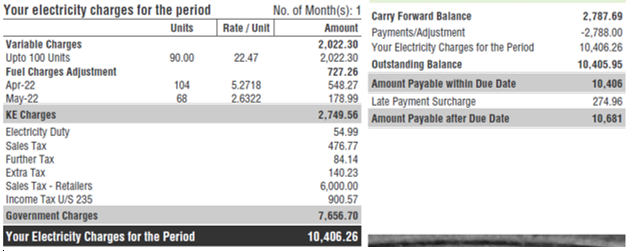

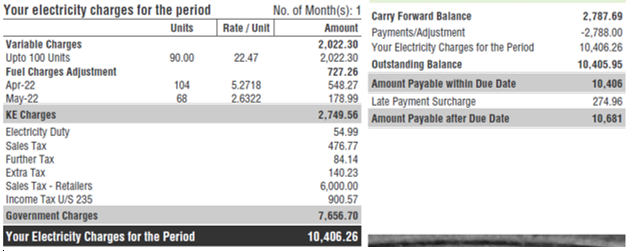

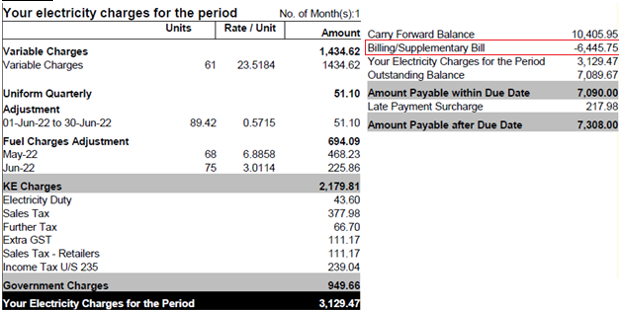

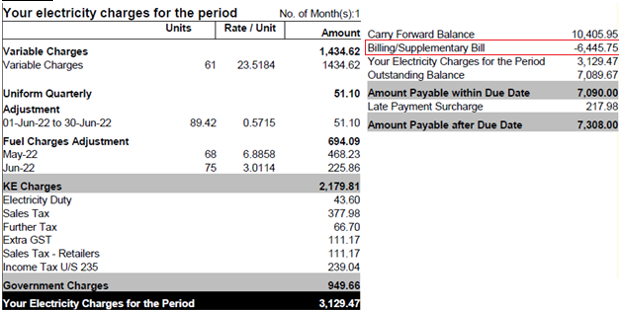

In case your July bill has not yet been paid, then please wait to receive your August 2022 bill. The tax charges for both July and August in this bill will be calculated per the mechanism followed before Finance Act 2022. As an additional facilitation, KE has waived Late Payment Surcharge for the unpaid July 2022 bills subject to the condition that both July (outstanding) and August (current) bills are paid within your August 2022 due date (mentioned on the bill). In case payment is not received within the August due date, Late Payment Surcharges for both July and August will be applicable. Customers will also be sent an SMS with a bitly link to their August 2022 should they wish to pay online through a wide variety of payment options https://www.ke.com.pk/customer-services/billls-and-e-payments/ . Your revised bill may look like the below:

JUL-22:

AUG-22:

Calculation:

| Bill of July-22 (Per Finance Act 2022) | Bill of July-22 (Revised to Methodology Prior Finance Act 2022) | ||

|---|---|---|---|

| Current month consumption (Variable Charges) | 2,022 | Current month consumption (Variable Charges) | 2,022 |

| FCA | 727 | FCA | 727 |

| Electricity Duty (2%) | 55 | Electricity Duty (2%) | 55 |

| Sales Tax (17%) | 477 | Sales Tax (17%) | 477 |

| GST Further (3%) | 84 | GST Further (3%) | 84 |

| Extra Tax (5%) | 140 | Extra Tax (5%) | 140 |

| Sales Tax – Retailers | 6,000 | Sales Tax – Retailers (5%) | 140 |

| Income Tax U/S 235 | 901 | Income Tax U/S 235 | 315 |

| Total Electricity Charges for the month | 10,406 | Total Electricity Charges for the month | 3,960 |

| Difference | (6,446) | ||

As a customer facilitation, KE has waived Late Payment Surcharge for the unpaid July 2022 bills subject to both July (outstanding) and August (current) bills being paid within your August due date (mentioned on the bill). In case payment is not received within the August due date, Late Payment Surcharges for both July and August will be applicable.

If you feel that the adjustment on your bill is erroneous, please call 118 or visit your nearest customer care center to understand the calculation.

If I haven’t consumed any electricity in the current month, how will my Sales Tax amount be adjusted?

In case your electricity consumption in the current month is zero, in such case the differential amount will be accredited in your next electricity bill.

Sales Tax on Retailers effective 1st July

Per Finance Act, 2022

Through Finance Act 2022, the Federal Government has revised the applicable Sales Tax on Retailers with effect from 01 July 2022. Thus your electricity bills for July onwards will reflect the revised slabs.

| Amount of Monthly Bill (PKR) | Sales tax on Unregistered Retailers (PKR) | |

|---|---|---|

| Active Taxpayer* | Inactive Taxpayer* | |

| 0 – 30,000 | 3,000 | 6,000 |

| 30,000 to 50,000 | 5,000 | 10,000 |

| Above 50,000 | 10,000 | 20,000 |

* under the Income Tax Ordinance, 2001

The Finance, Act 2022, can be download from the FBR website. Click HERE to download [Page No. 13]. Section 3(9) of the Sales Tax Act, 1990

Prior to Finance Act, 2022

The applicable sales tax on retailers prior to Finance Act, 2022 was as follows:

| Amount of Monthly Bill (Rs.) | Rate of Sales Tax on Retailers |

|---|---|

| Upto 20,000 | 5% |

| Above 20,001 | 7.5% |

A person who not only duly files his/her income tax returns but whose name also appears on the Active Taxpayers List (ATL) issued/updated by Federal Board of Revenue (FBR).

Click HERE to check your Active Taxpayer status on the FBR website. Per the revision in Sales Tax on Retailers, customers whose names do not appear in the ATL will be charged a higher rate than those whose names appear on the ATL list.

Q 8. Will I be charged Sales Tax even if my shop is vacant or if my electricity consumption is zero?

Per the Finance Act 2022 by the Federal Government, a minimum of PKR 3,000/- Sales Tax will be applied on Retailers who are also Active Taxpayers under the Income Tax Ordinance, 2001. The amount will be double in case customers are not listed on FBR’s website as Active Taxpayer.

Taxes are controlled and collected by various Government entities / FBR as and when notified. K-Electric only acts as a collecting agent on behalf of the Government. Collected taxes are deposited with the government agency that has enforced them and are outside of KE purview.

Per Sales Tax Act 1990, Sales Tax on Retailers is not applied on electricity bills if customer is registered retailer under the Sales Tax Act, 1990 and details appear in Federal Board of Revenue’s (FBR) Active Taxpayer List (ATL). Customers can check their particulars on the FBR website HERE by selecting Taxpayer Profile Inquiry.

The customer can also approach the concerned Commissioner of Inland Revenue to issue order for exclusion as a Retailer.

Retailers can minimise their Sales Tax by providing their CNIC, NTN and/or STRN (if applicable) and other details to their electricity provider.]

*If you are an Active Taxpayer and/or a Registered Retailer per the FBR website AND your KE account name and address is the same as the name and address on your CNIC or/and NTN /STRN, please immediately share a scanned copy of CNIC and NTN / STRN with us. You may also visit a KE Customer Care Centre with a copy of your valid CNIC, NTN and STRN certificates and your KE Account Number.

In terms of Section 2(43A) of the Sales Tax Act, 1990, following retailers are required to obtain registration under the Sales Tax Ac, 1990.

Changes inserted vide Finance Act, 2022

In case you feel that the Sales Tax on Retailers has been charged erroneously on your electricity bill despite updated CNIC, NTN and/or STRN (if applicable) details with KE and inclusion in the FBR’s Active Taxpayer List, please immediately visit your closest Customer Care Centre for correction of the bill. Alternatively, you may write to us at tariff.helpdesk@ke.com.pk. We will aim to rectify any mistake within 10 working days.

In case you are not a Retailer and have been charged this Sales Tax, please update your details in KE’s database HERE. You can also approach the Concerned Commissioner of Inland Revenue to obtain an order for exclusion as retailer.

In case the name appearing on the KE bill differs from the name appearing on the NTN and/or STRN, then KE can update the User section of the of the electricity bill with your name and CNIC, NTN, STRN details only if your KE billing address matches the address mentioned on your CNIC / NTN and/or STRN. Please upload a scanned copy of your documents HERE along with your KE customer account details

Please apply for a Change of Name to update the KE bill. Visit your nearest IBC and submit the duly filled form along with the registered sale deed (ownership proof), attested copy of your CNIC, NOC from previous owner, a copy of your last paid bill (evidencing that no arrears are pending) and Undertaking at any KE Customer Care Centre. You may also apply for a Change of Name online via:

The KE Live App

- https://www.ke.com.pk/live-playstore (Google Play)

- https://apps.apple.com/pk/app/ke-live/id1458106362 (App Store)

KE Live Web Portal

The Change of Name process may take up to twenty (20) working days. You will receive a confirmation of completion via SMS. We will update your user account details on receipt of your complete request.

Retailers can minimise their Sales Tax by providing their CNIC or NTN and/or STRN (if applicable) and other details to their electricity provider. Click HERE to update your details in the KE system.*

*If you are an Active Taxpayer and/or a Registered Retailer per the FBR website [check HERE by selecting Taxpayer Profile Inquiry] AND your KE account name and address is the same as the name and address on your CNIC and NTN /STRN, please immediately share a scanned copy of CNIC and NTN / STRN with us. You may also visit a KE Customer Care Centre with a copy of your valid CNIC, NTN and STRN certificates and your KE Account Number.

No, Sales Tax on Retailers paid under Sales Tax Act, 1990 will be treated as discharge of tax liability under the Income Tax Ordinance, 2001 under Section 99A of the Income Tax Ordinance, 2001.

Yes. Sales Tax on Retailers is in addition to aforesaid taxes.

If you are a retailer operating from a rented premises and the address of the premises on your NTN and/or STRN matches the billing address mentioned on the KE Bill, then upload scanned copy of your CNIC or/ NTN and/or STRN HERE along with your KE customer account details to update the User details (name and CNIC) on KE bill.

The address on your NTN / STRN must match the address mentioned on your KE bill for your user account details to be updated and for you to be eligible for the Sales Tax on Retailers reduction/exemption.

You can conveniently update your details online in the FBR system HERE.

Customers whose details have been updated in the KE system shall receive an auto-generated SMS confirming the update. In addition their CNIC, NTN and/or STRN shall be printed on the next bill that they receive.

Yes, if the owner or tenant are a tax-filer and/or a registered retailer and the address on the NTN and/or STRN match the address printed on the KE electricity bill.

| SRO 1004 | July 07, 2022 |

| SRO 1175 | July 25, 2022 |

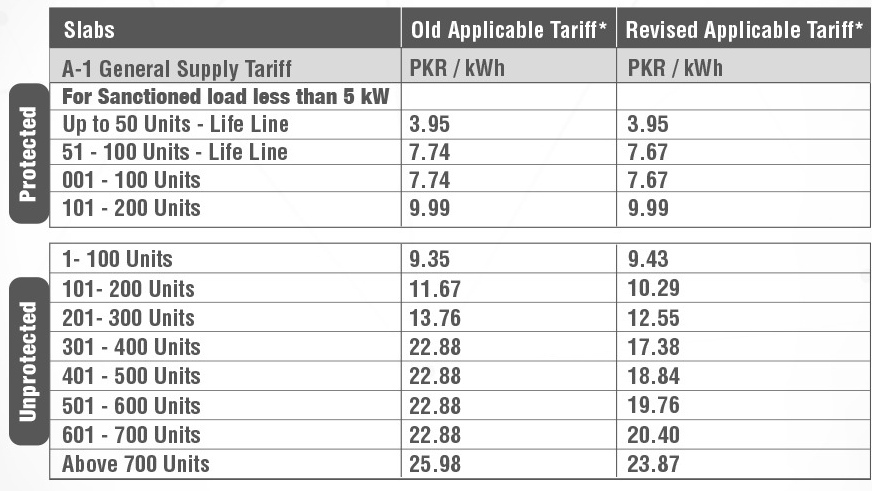

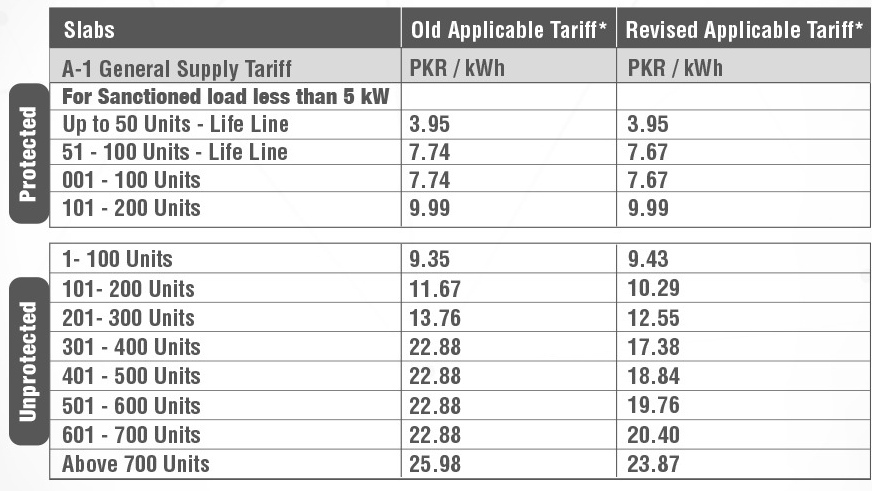

Per SRO 1004 by Ministry of Energy, Residential Tariff Slabs and Calculation Methodology were revised for Residential customers billed under the Slab model from July 07, 2022. Click HERE to see the SRO.

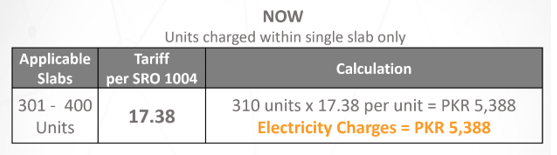

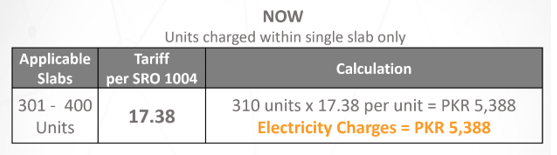

Prior to this SRO, one-slab benefit for Unprotected category was allowed and consumption was divided in current and one previous slab. This mechanism has now been withdrawn & consumption will be charged within a single slab only.

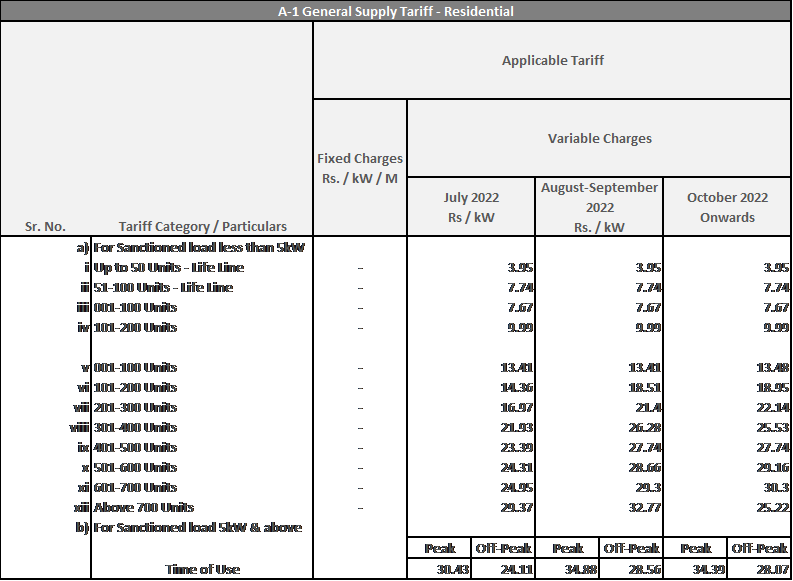

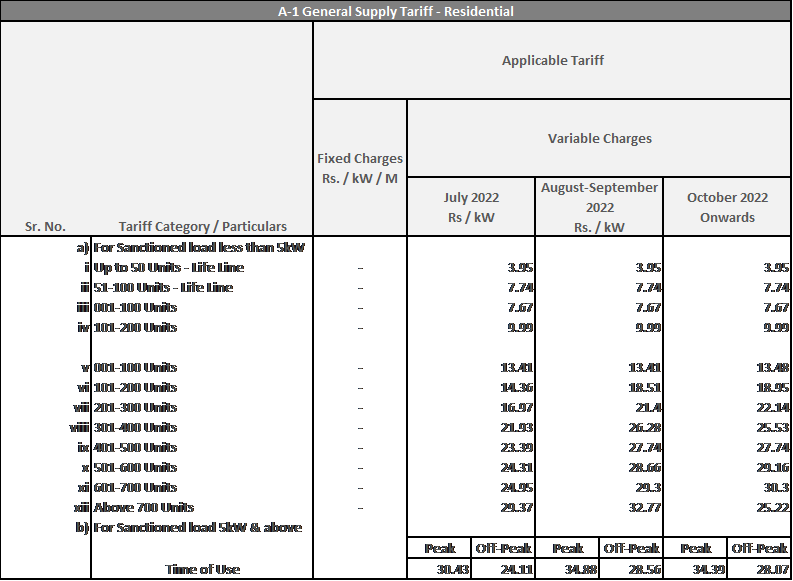

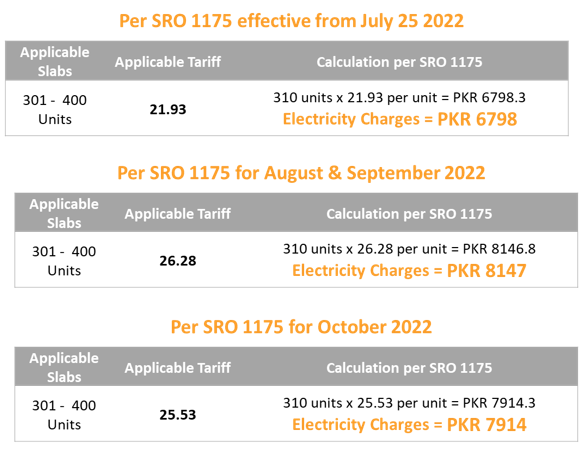

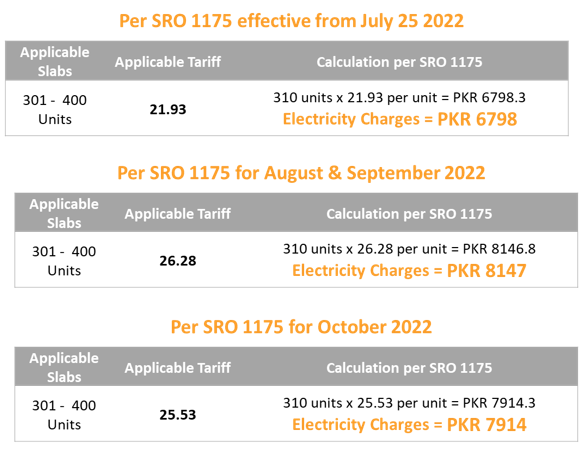

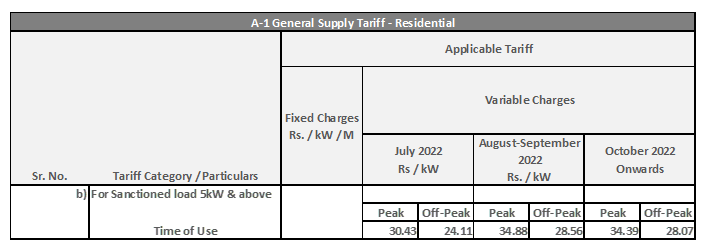

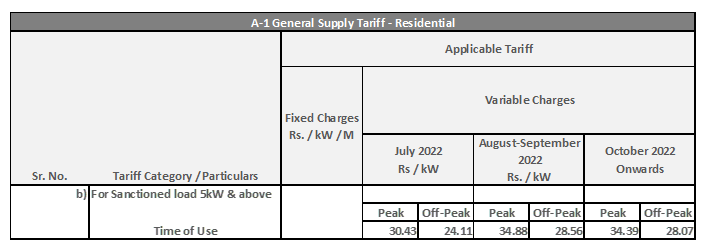

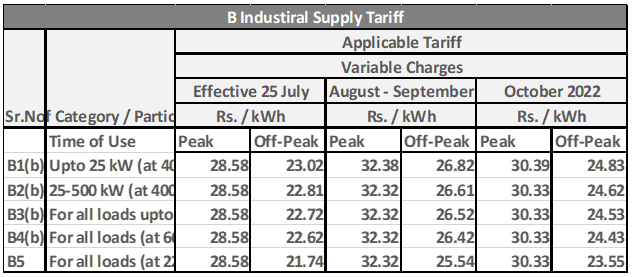

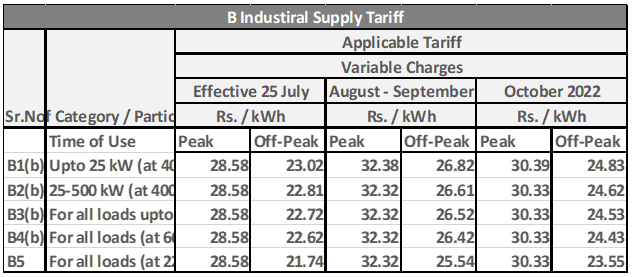

SRO 1004 has now been superseded by SRO 1175 which was notified by the Ministry of Energy for customers of K-Electric from July 25, 2022 onwards wherein the tariff rates have been further revised. Based on this SRO, tariff has been revised for all Residential customer categories i.e. customers billed under Consumption Slab model and customers billed under the Time of Use model. Click HERE to see the SRO. Per the SRO which ensures uniformity of tariffs across Pakistan, electricity prices per unit for residential customers billed under the Unprotected slabs and the Time of Use mode will increase on July 25, 2022, followed by subsequent revision on August 01, 2022 and October 01, 2022.

Per SRO 1175 which was notified by the Ministry of Energy for customers of K – Electric from July 25, 2022 onwards, revised tariffs are applicable for all customer categories including Commercial, Industrial and Residential. Click HERE to see the SRO. Accordingly, electricity prices per unit for all the customers (excluding Protected consumers) will increase from July 25, 2022, followed by subsequent revision on 1st August 2022 and 1st October 2022.

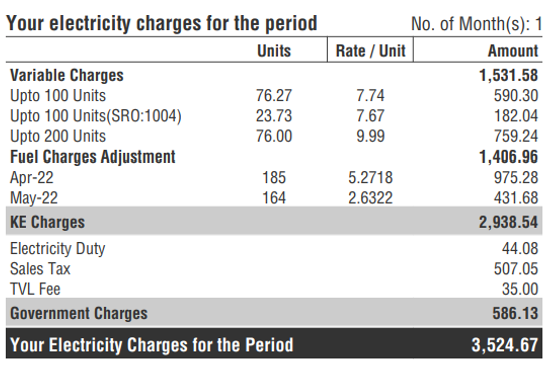

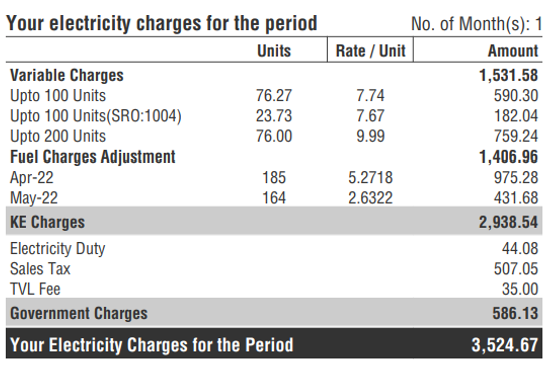

Per Tariff terms and conditions approved by NEPRA, Residential customers with sanctioned load below 5 kW are billed based on their consumption slab according to Tariff rates notified by the Government of Pakistan. [You can check your sanctioned load on the top right corner on the back of the KE bill].

Similarly, your bill calculation [on the back of the bill] will clearly mention units consumed and the slab that they have been billed under:

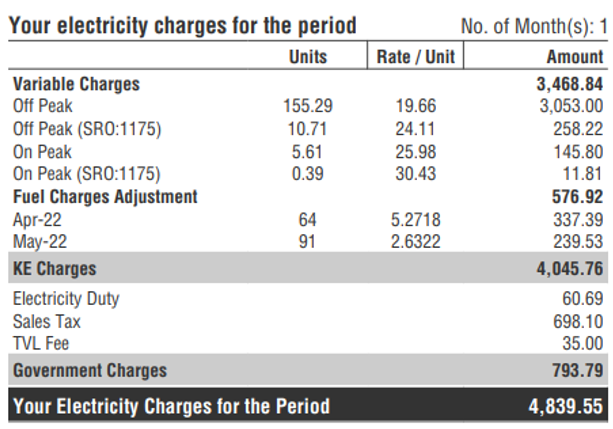

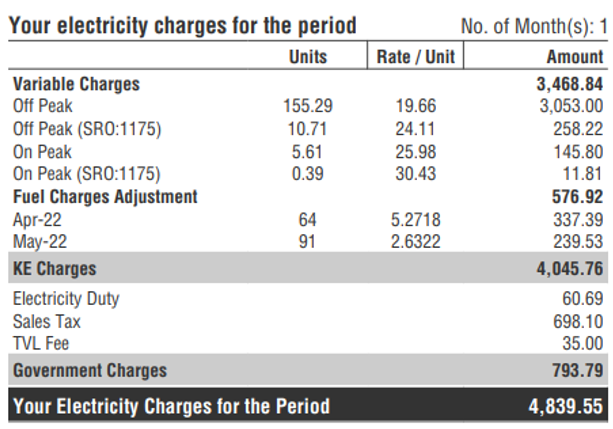

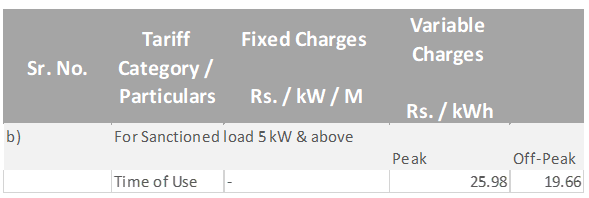

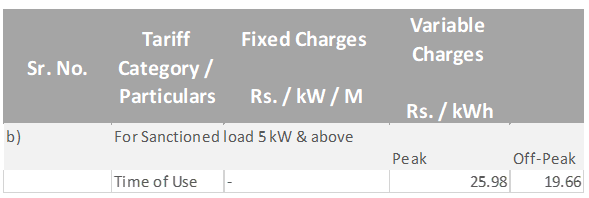

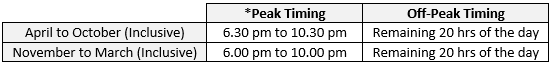

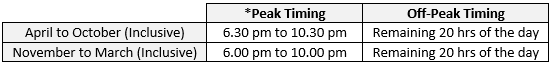

Residential customers whose Sanctioned Load is 5kW or above are billed under a Time of Use mode. As such your bill calculation will show your electricity unit consumption based on Peak and Off-Peak hours.

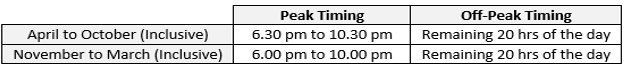

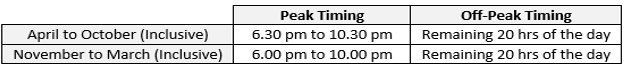

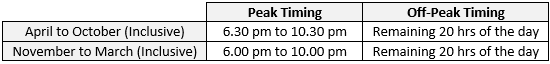

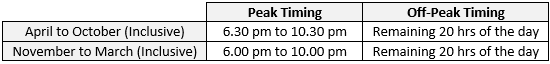

This is the application of tariff according to the time in which energy is consumed. These rates vary by time of day: more expensive during peak demand hours and less expensive during low demand periods. TOU has been implemented across all Distribution Companies (DISCOs) across Pakistan to encourage responsible consumer consumption and ease the strain of energy usage during maximum demand periods. Billing for eligible customers will be based on their consumption during peak/off-peak hours which are as per below:

As both SRO 1004 and SRO 1175 have been notified by Ministry of Energy for Slab-based Residential Customers for July, your electricity bill for July may look a little different than usual. You may see at least two and up to three separate tariff entries on account of SROs 1429, 1004 and 1175 respectively. Click on the hyperlinks to check these SROS.

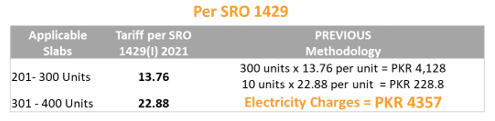

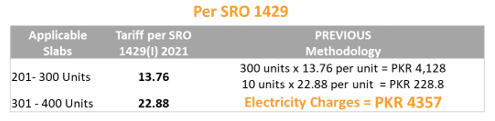

Your consumption prior to July 07, 2022 has been charged per the previous slab structures under SRO 1429 dated November 5, 2021 & one slab benefit has been provided for this consumption.

Consumption from July 07 to July 24, 2022 has been charged according to the revised slabs and calculation methodology per SRO 1004 by the Ministry of Energy notified on July 07, 2022. Your energy consumption has now been calculated without benefit of one slab as the same has been withdrawn. However, protected residential consumers (excluding lifeline consumers) will still get one slab benefit.

Consumption from July 25 to July 31, 2022 will be charged according to the revised tariff slabs per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. The removal of slab benefit implemented through SRO 1004 will be continued.

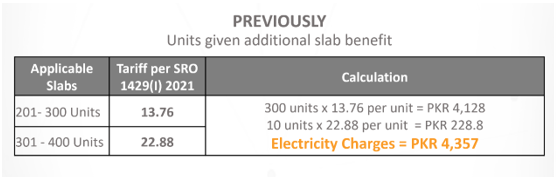

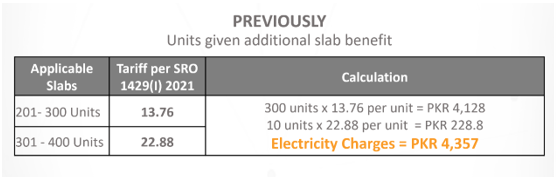

Per SRO 1429(I)/2021 applicable till July 06, 2022, residential customers billed under the Slab mode received one slab benefit by being billed in 2 slabs. The calculation for 310 units with the slab benefit looked like:

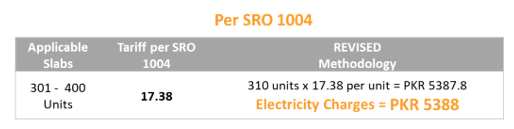

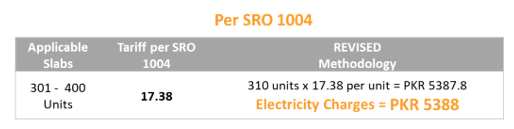

Residential Tariff Slab calculation methodology has been changed per SRO 1004 notified by Ministry of Energy on July 07, 2022 and the benefit of one previous slab has been withdrawn for Unprotected Residential customers. The calculation for 310 units without the slab benefit will look like:

In addition, tariff rates have been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022.

The calculation for 310 units of electricity for July, August and October will now be:

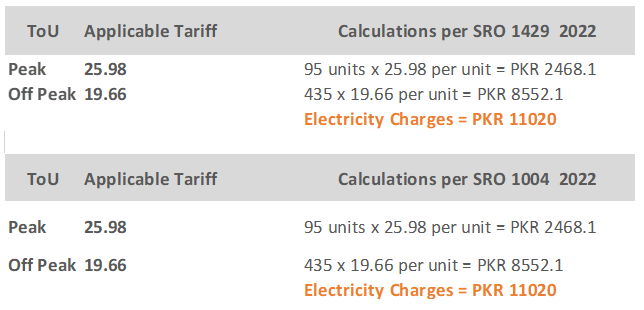

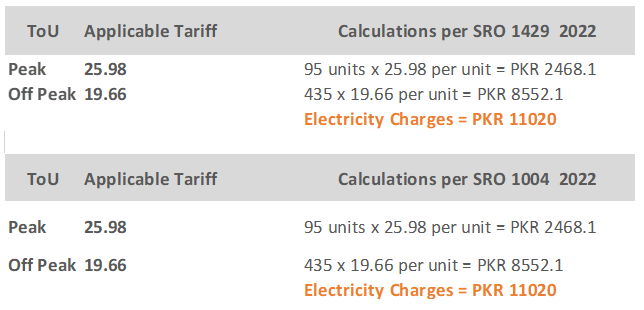

Your consumption up to July 24, 2022 has been charged per the Time of Use tariff under SRO 1429 and SRO 1004 (the ToU rates are same in both the SROs) which is

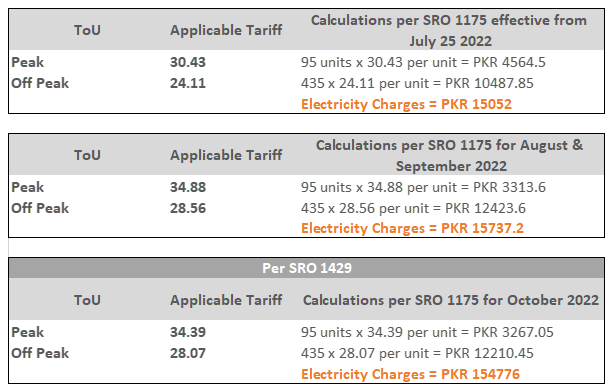

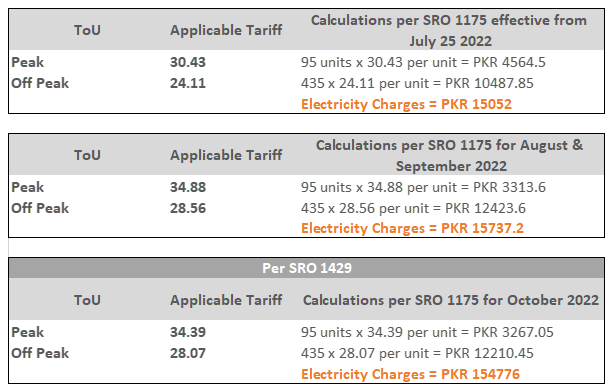

Consumption from 25th July onwards will be charged according to the revised tariff slabs per SRO 1175

Customers are billed under the Time of Use model through special TOU meters installed at their premises. These track electricity consumption during both Peak and Off-peak hours. These units are then respectively billed against applicable Peak and Off-peak tariffs per the applicable SROs.

Time of Use rates under SRO 1429 and SRO 1175 (ToU rates were same in both the SROs) were applicable for TOU Residential Customers till July 24, 2022. Electricity charges under these SROs for 95 Peak-hour units and 435 Off-Peak hour units looked like:

Time of Use rates been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. Electricity charges under this SRO for 95 Peak-hour units and 435 Off-Peak hour units for July, August & September, and October will now be:

One slab benefit refers to the billing mechanism where the total units of electricity consumed are divided into two slabs i.e., the current slab and one previous slab. As an example, the calculation for 310 units of electricity with one slab benefit was:

Per SRO 1004 notified by Ministry of Energy dated July 7, 2022, with the removal of one slab benefit the total consumption will be billed in current slab only.

The calculation for 310 units of electricity with withdrawal of one slab benefit will now be:

The tariff rates have been further revised on July 25, 2022 as per SRO 1175.

As per Tariff Terms & Conditions approved by NEPRA and notified by GoP dated November 5, 2021 “Protected customers” refers to Non-ToU Residential customers consuming less than or equal to 200 units per month consistently for the past 6 months.

All other Non-ToU Residential customers (with sanctioned load below 5 kW) who don’t fall under the protected category would be categorized as Unprotected Customers as per the Tariff Terms & Conditions.

The revised tariff rates per SRO 1175 are applicable on all the consumers of K-Electric effective from July 25, 2022.

We know these are difficult times; that’s why we wanted to give notice before these costs are seen on bills so that you can take necessary conservation steps to reduce their impact. It is important to emphasise that reducing energy wastage and conserving electricity are proven routes to controlling your bill. Follow @KElectricpk on Facebook for energy conservation tips and tricks.

For customers billed under the TOU mode, consciously limiting non-essential consumption (operating water-motors, ironing clothes etc.) during Peak-hours can make a big difference to your electricity bills.

Further, to support customers during this time, we are partnering with various financial entities to offer rebates and various flexible payment options that may support during this time.

Zero-Rated Industrial Support Package (ISPA)

Per direction by Government of Pakistan dated September 10, 2021, Export oriented industries were provided relief by restricting their electricity rates to US 9 cents per kWh till June 30, 2022.

With no further extension by GoP, this relief was discontinued with effect from 1st July 2022, and Export-oriented Industries were charged as per their actual tariff categories for the month of July 2022.

However, based on the letter of GoP dated August 12, 2022, the relief of concessionary tariff has been implemented again restricting the electricity rates to US 9 cents per kWh effective 1st August 2022.

Effective January 1, 2021, a standard operating procedure (SOP) was devised and notified on December 30, 2020 by FBR after due as per ECC direction dated Dec 2, 2020 in consultation with Ministry of Commerce and other stakeholders for registration of new manufacturers for concessionary tariff rates (i.e. US 9 cents per kWh). Main features of the SOP are as under:

- For new registration, applicants may apply through their representative Associations (for e.g: APTMA, PTEA, PHMA etc.).

- The Association, after proper verification, may forward the application to the Export-Oriented Sector Registration Cell (ESRC) of FBR, as per specified format duly signed by Chairman Association.

- ESRC after due examination and re-verification shall forward the application to the Ministry of Commerce while any discrepancy, if any, identified by ESRC shall be referred to FBR field teams.

- On receipt of direction from Ministry, DISCOs shall charge the concessionary tariff in case the taxpayer is an active taxpayer. Standard tariff would be charged if the taxpayer is not an active taxpayer for the relevant period.

- Any taxpayer not registered with respective Association may approach FBR field teams for verification of its business particulars and for onward submission of report to ESRC.

- The newly enrolled taxpayer shall be entitled to avail concessionary tariff prospectively.

Yes, these changes are applicable nationally based on GoP’s uniform tariff policy subject to approval of Federal Government and the above SOP.

Your tax liability will also be increased as per your electricity consumption.

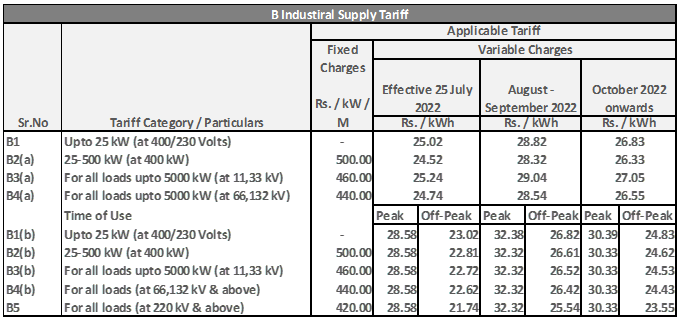

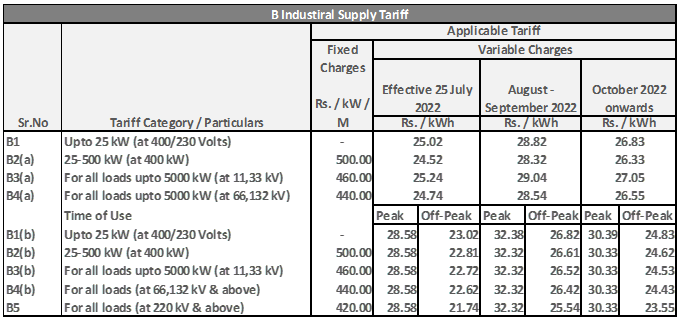

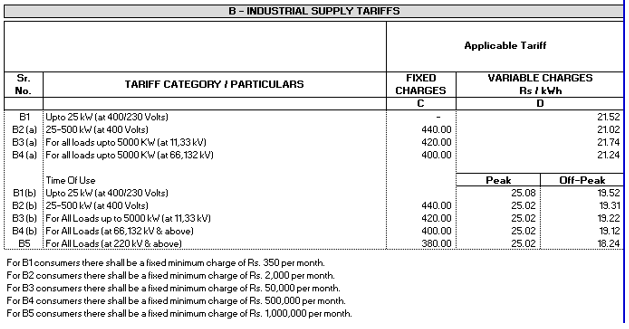

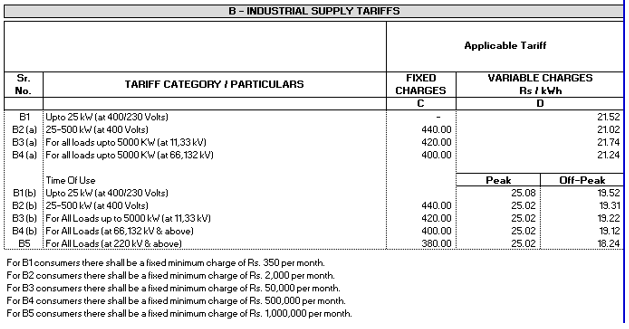

Per SRO 1175 for Industrial Customers

In addition to this tariff notification, two additional changes will impact industrial customers bills from July onwards.

Removal of Peak Hour Relief for Industrial consumers: Industrial customers were provided relief in form of charging their Peak Hours utilization at Off-Peak Rates nationally. This relief was initially effective from 1st November 2020, till 30th April 2021; it was further extended till 30th June 2022 by NEPRA’s decision dated June 17, 2021.

As there has been no further notice of extension, with effect from 1st July 2022, Industrial customers across Pakistan will be charged at the Peak Rate for their Peak hours utilization. This change will reflect in the July bill onwards.

Removal of Zero-Rated Industrial Support Package (ZRISPA): Per direction by Government of Pakistan dated 10th September 2021, export-oriented industries nationally were provided relief by restricting their electricity rates to US cent 9 per kWh till June 30, 2022.

With no further extension by GoP, this support has been discontinued with effect from 1st July 2022, and Export-oriented Industries will now be charged as per their actual tariff categories, until any further notice by GoP.

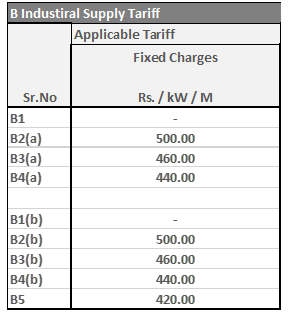

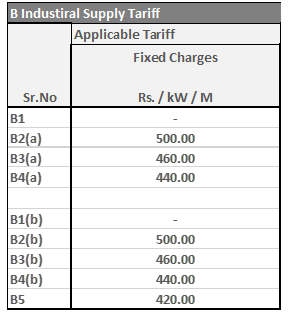

Per SRO 1175 dated 25th July 2022, both the applicable rates of Fixed Charges and the charging mechanism have been revised. Fixed charges will now be charged based on either Maximum demand in the month or 50% of sanctioned load, whichever is higher. In case where fixed charges will be based on above mechanism, “fixed minimum charges” will be removed. For B1 Customers, there will be a fixed minimum charge of PKR 350 per month, same as in previous SRO.

For B1 consumers there shall be a fixed minimum charge of Rs. 350 per month.

The applicable fixed charges shall be billed based on 50% of the sanctioned load or Actual MDI for the month whichever is higher. In such case there would be no minimum monthly charges even if no energy is consumed

Yes, these changes are applicable nationally based on GoP’s uniform tariff policy.

This relief was applicable on industrial customers having TOU tariff, falling into any of the following categories i.e., B1, B2 B3 B4 & B5.

Peak subsidy was approved till June 30, 2022. As there has been no further extension in the peak hour relief provided to Industrial electricity customers, accordingly these customers will be charged Peak and Off-Peak rates from July 1, 2022.

Peak subsidy was approved till June 30, 2022. As there has been no further extension in peak subsidy, Industrial Customers (ToU) will be billed according to the below Time of Use (ToU) Tariff

From 1st – 6th July, SRO 1429 was applicable, the industrial rates of which are same as mentioned in SRO 1004 dated July 7th 2022

From July 7th – 24th July per SRO 1004, applicable Tariff will be

From July 25th onwards per SRO 1175, applicable tariff will be

For B1 consumers there shall be a fixed minimum charge of Rs. 350 per month.

The applicable fixed charges shall be billed based on 50% of the sanctioned load or Actual MDI for the month whichever is higher. In such case there would be no minimum monthly charges even if no energy is consumed

Five export sectors namely Textile, Carpet, Leather, Sports and Surgical Goods fall under the Zero Rated category.

In case you feel that the tariff has been erroneously applied on your electricity bill, please immediately visit your closest Customer Care Centre for correction of the bill. Alternatively, you may write to us at tariff.helpdesk@ke.com.pk. We will aim to rectify any mistake within 10 working days.

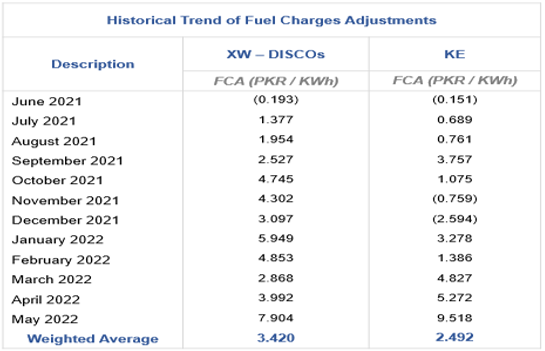

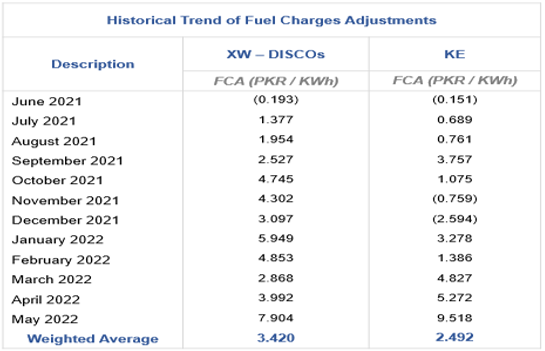

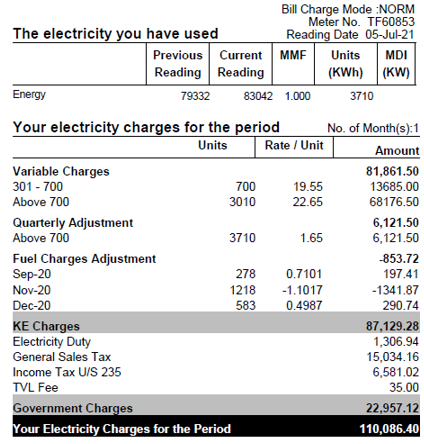

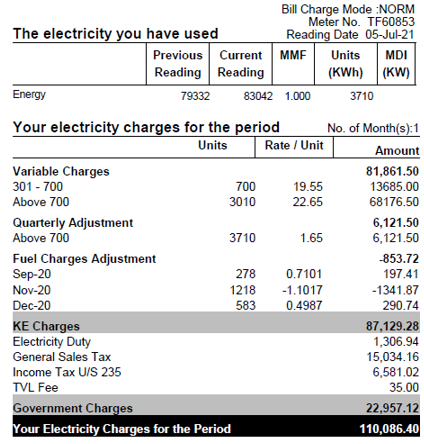

The Fuel Charge Adjustment (FCA) is an approved adjustment allowed to electricity utilities by NEPRA on account of monthly variation in fuel prices, generation mix and volume Accordingly, there may be both positive as well as negative adjustments for FCA.

FCA for each month is determined by NEPRA and these costs are passed through to customers in their monthly electricity bills following NEPRA’s scrutiny and approval. The notification issued by NEPRA for application of FCA includes details of the amounts and the months where FCA is to be applied. For example, FCA of March 2022 is to be applied in June 2022 as per NEPRA’s decision.

Consumers also receive a benefit when the cost of fuel decreases.

It is important to note that this is retrospective recovery of costs already incurred by KE in previous months.

For more information, watch this explainer video: https://youtu.be/NBjANwfeKx0

FCA calculation mechanism is the difference between weighted average fuel cost per unit sent out for the month as compared to weighted average fuel cost per unit sent out for reference month i.e. last month of last quarter.

Sample calculation formula for September 2021, along with extract from MYT for FCA mechanism is attached here.

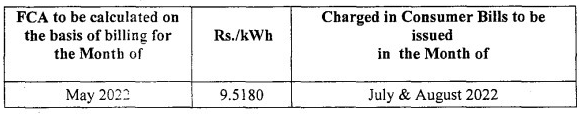

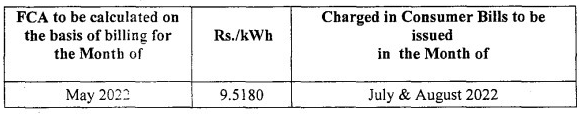

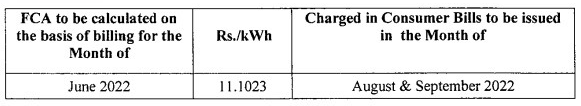

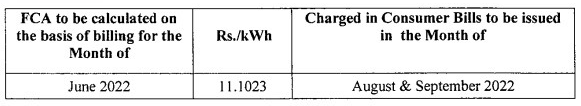

Within its determination, NEPRA provides for the amount of Fuel Charge Adjustment and its charging months.

For example, March 2022 FCA was allowed to be charged in the month of June 2022.

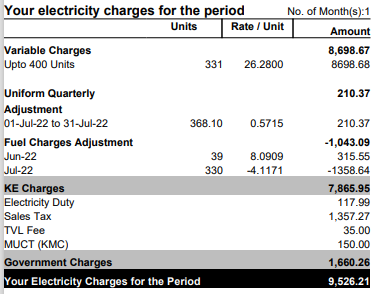

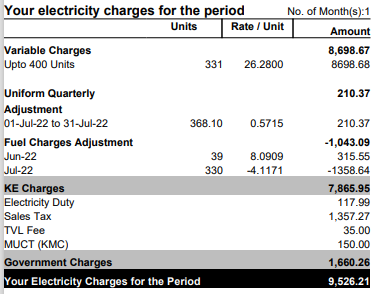

Accordingly, as per NEPRA’s decision, FCA for the month of April and May 2022 (partial) are being charged in electricity bills of July 2022, which may reflect multiple entries in the FCA calculation section of you July 2022 bill.

| FCA for the Month | Applicable Month | Total FCA | |

| Jul-22 | Aug-22 | ||

| Apr-22 | 5.2718 | – | 5.2718 |

| May-22 | 2.6322 | 6.8860 | 9.5180 |

| Total | 7.9040 | 9.8972 | |

Similarly the FCA for June will be applied partially to August and September electricity bills per the SRO 1424 ( https://www.ke.com.pk/assets/uploads/2022/08/FCA-Decision-June-2022.pdf). Of total allowed FCA, Rs. 3.0114/kWh shall be charged in August 2022 and the remaining amount of Rs. 8.0909/kWh shall be charged in September 2022.

Follow @kelectricpk for energy saving tips.

- Positive FCA i.e fuel cost increase are applied across all customer categories; Residential, industrial commercial except lifeline consumers.

- Negative FCA i.e. fuel cost reductions are not applied to lifeline consumers, residential consumers having consumption up to 300 units in that month and agriculture consumers

For example, please refer positive FCA SRO for the month of September 2021 here and negative FCA SRO for the month of December 2021 here

- Fuel Cost increases are not applicable to lifeline consumers. For definition of lifeline consumers, please refer Question 23 of Tariff Queries

- Fuel Cost reductions are not applied to lifeline consumers, residential consumers having consumption up to 300 units and agriculture consumers

EXAMPLE: FCA for the month of July multiplied by the number of units consumed in the month of July.

The negative FCA means that KE will not collect any amount under the FCA head and in fact KE will credit the amount equivalent to units consumed in July-22 at rate of PKR 4.1171 kWh.

For more information, watch this explainer video: https://youtu.be/NBjANwfeKx0

While consumer bills are generated against electricity consumed, loadshed is based on the proportion of losses on a feeder level, which are determined on the basis of theft of electricity and non-payment of bills. This is in line with the Government of Pakistan’s National Power Policy and applicable across the country.

The revised loadshed schedule is being implemented due to various factors including rising demand of electricity and temperatures. However this increase in duration of loadshed is a temporary measure. We will continue to keep consumers updated of the changes through our regular channels.

KE is engaged with all relevant stakeholders for the urgent release of legitimate dues which are critical to continue purchase of fuel. At the same time, KE is making all endeavors to secure cheaper indigenous fuel.

The updated schedule has been uploaded on KE’s website

Customers registered via KE’s 8119 service are being informed of this change through advance SMS.

To register yourself for SMS updates, type ‘REG’, followed by a space, followed by your 13-digit account number and send it to 8119

The schedule is available on our website. It can also be accessed via the KE Live App, KE’s WhatsApp Self-Service Portal, Social Media, and Call center 118

If the consumer sells the premises where the connection is installed, it shall be obligatory upon the new owner to apply to KE for a change of name. Such an application shall be accompanied by written consent of the previous owner regarding transfer of the security deposit in the name of the new owner.You can get your name updated on the bill by providing the following documents:

-

- Sales agreement / Sales Deed / Sub Lease / Mutation Letter

- CNIC copy

- Last paid bill

- NOC on Rs. 100 bond paper from applicant

Additional documents for Industries only:

-

- Trade licence

- NTN certificate

Additional documents in case of tenant:

-

- Tenancy agreement

- CNIC copy of owner

Additional documents for Kachi Abadi:

-

- Reference letter of Town Nazim. Copies of documents must be attested by Gazette officer. Original documents should be brought to the IBC at the time of submission of application.

Bills are prepared and dispatched each month on a specific date. However, in case of non-receipt of your bill, you can do the following:

- Click here to generate a duplicate bill

- Email us at bill@ke.com.pk

- Visit your nearest IBC to get a duplicate bill.

- Call 118

The collection of the TV license fee through electricity bills was introduced by the Government of Pakistan through the Finance Act 2005. Pursuant to this, KE has been a collecting agent for the TV License Fee since May 2008. Exemption certificate issued from PTV can be submitted by the consumers at customer care center of KE for processing of TV licensee fee waiver. Alternatively, the exemption form (available at https://www.ke.com.pk/media-center/downloads/) can also be downloaded and submitted to KE after filling the required information with following documents so that the same will be forwarded to PTV on behalf of consumers for further processing of TV licensee fee waiver:

1. Consumer Application

2. Last paid KE bill copy (of both side)

3. CNIC copy of applicant

4. Affidavit on Rs.50 /- Stamp paper

KE has devised a strategy based on two key drivers:

- Theft (illegal kunda connections)

- Recovery ratios (bill payment by consumers)

Aggregate Technical and Commercial Losses (ATCL) determines how many hours of load-shed will be planned for each zone.

KE has divided Karachi into four zones:

Currently, 61% of Karachi, including low loss residential areas and industrial zones, is exempted from load-shed (as of Jan 2015). In 2008-2009, only 28% of the city was exempted from load-shed. We can’t continue to provide uninterrupted supply in areas where we don’t get paid for the services we provide.

Most certainly. If consumers in an area support KE in combatting theft and duly pay their bills, then as per KE policy they will be moved to a lower loss zone depending on the losses reduced and hence face a lower duration of load-shed.Analysis of the area Aggregate Technical and Commercial Losses (ATCL) is conducted after every three months, whereby depending upon the losses in the area, the load-shed duration is applied.

KE has also initiated Project Ujala whereby the utility collaborates with communities across Karachi to install ABCs and low-cost meters for those consumers who were previously abstracting power illegally. Community support is proving to be a sustainable way to not only combat theft but also improve the quality of life for the communities and residents concerned.

KE has also launched the low-cost meter drive in various areas of Karachi, whereby consumers who are currently not part of our network are encouraged to convert to low-cost meters without risk of any prosecution for power theft or illegal abstraction.

KE has launched the Smart Grid project, which allows monitoring of electricity remotely and will have a major impact on controlling electricity theft. The project is currently in its pilot phase in North Karachi; we plan on expanding it across Karachi.

KE regularly conducts kunda removal operations in various areas, regular updates of which are made to the consumers via our communication channels (including social media).

KE also conducted crackdowns against defaulters and power thieves with the ‘Name and Shame’ campaign in 2011-2012 and Operation Burq in 2015-2016.

K-Electric has also set up a dedicated channel Speak Up whereby consumers can report theft anonymously by emailing speakup@ke.com.pk .

Community support is vital to reduce theft in an area. While KE has taken various initiatives to control theft, only in areas where the community has joined KE’s efforts has there been a sustainable solution for reducing theft. This in turn benefits the residents of the locality in the form of reduction in load-shed and faults.

https://www.ke.com.pk/load-shed-schedule/

To find the name of your respective feeder, download our KE Live mobile app, or call 118 or inquire through KE Social Media (facebook and twitter). Please note only the list of feeders that will face load shedding are mentioned here.

- Customers can get 2% of the total bill amount paid. Max cashback limit will be Rs. 600, for normal days digital payment through Savyour

- Customers can avail 4% cashback of the total bill amount paid, with cap of PKR 1200/- normal days Visa card digital payments through Savyour

- Customers can earn up to 10% cashback on weekends(*) if you pay via VISA credit or debit card. Max cashback limit will be Rs. 2100.

(*)Days are subject to change

- Download Savyour App via Playstore or App Store.

- Sign up using your Apple, Facebook or Google account.

- Select K-Electric from the list of brands in-App.

- Tap “Get Cashback” which will redirect you to KE’s website.

- Pay your bill as per KE’s guidelines.

Once done, you will be notified regarding the cashback in your Savyour App, which will be listed in the Pending Balance in your Savyour Wallet. This cashback will be released in 5 days.

- You must go to the KE website by using the Savyour App first.

- The cashback will be credited in to your Savyour wallet in 7 working days.

- Customers can get 2% of the total bill amount paid. Max cashback limit will be Rs. 600, for normal days digital payment through Savyour.

- Customers can avail 4% cashback of the total bill amount paid, with cap of PKR 1200/- normal days Visa card digital payments through Savyour.

- Customers can earn up to 10% cashback on weekends(*) if you pay via VISA credit or debit card. Max cashback limit will be Rs. 2100.

(*)Days are subject to change. - For support related to cashback, open Savyour App > go to Wallet > Tap Contact Us.

- In no event shall K-Electric or any of K-Electric’s employees/ officers in any way be liable or responsible for any obligation, representation or warranty contained herein, whether express or implied.

- There is no minimum limit on bill amount for cashback.

A solar PV (Photovoltaic) system absorbs the sun’s irradiation and converts it into electricity. Solar panels are made of highly conductive materials. When the sun rays hit the solar panels, it generates DC (direct current) power. The DC energy passes through an inverter to become the AC (alternating current) power which becomes electricity that lights up the connected load.

- Grid connected solar PV system: the on grid solar system is tied to your local utility’s grid. This is the most common system that is used in residential settings. The residence will be covered if there is requirement for more energy than that produced by the solar PV system as it will be able to take it from the grid. In case of surplus energy, the excess energy can be sold to the grid as per the National Electric Power Regulatory Authority (Alternative & Renewable Energy) Distributed Generation and Net Metering Regulations, 2015.. An on-grid system will use the energy produced from the solar panels during the day and will switch to the grid electricity during the night.

- Off – grid solar system: An off grid solar system means that you are not connected in any way to the grid. To achieve this however, there is a need to purchase back up battery systems, which can be expensive, bulky and are not very environment friendly. The battery systems will be charged during the day from the energy produced by the panels and will be used during nighttime.

- Hybrid solar system: A hybrid solar system refers to a combination of solar and energy storage while also being connected to the grid.

) which comes with a 100+ years of experience in the power sector. K-Solar has developed partnerships with leading suppliers of solar equipment which allows it to offer the best in class solutions to its customers. K-solar will also be offering its customers the option of a Smart Solar & Energy Monitoring system.

At K-Solar, the idea is to provide the customers with a one window solution for all their solar needs by providing, robust, quick and quality installations. K-Solar will be building on KE’s customer centric approach and providing round the clock services to its customers. K-Solar will also be building on the strong financial grounds of KE.

| Items | Warranties |

|---|---|

| Solar modules | 10 Years (Replacement)/ 25 Years (Performance) |

| Solar Invertor | 10 Years (Replacement) |

| Solar Structure | 10 Years (Maintenance) |

| Workmanship(Miscellaneous plant equipment) | 2 years |

Solar Panels Make: Longi (China) [Tier-1 equipment]

Solar Inverters Make: Sungrow (China) [Global leader in inverters]

Please refer to K-Solar calculator for specific details.

For a thumb rule: 10kW On grid system will produce around 1500Units on monthly basis

To keep roof area usable, elevated/semi-elevated solar mounting structure could be chosen, which costs 10-15% more than standard roof mount structure.

Residential Customers:

| S.No | Gross amount of billed | Active Tax Payer | Inactive Tax Payer |

|---|---|---|---|

| 1 | if the amount of monthly bill is less than Rs 25,000/ | 0% | 0% |

| 2 | if the amount of monthly bill is Rs,25,000/- or more | 0% | 7.5% |

Industrial & Commercial Customers:

| S.No | Gross amount of billed | Tax rate |

|---|---|---|

| 1 | Upto Rs. 500 | Rs. 0 |

| 2 | exceeds Rs. 500 but does not exceed Rs. 20,000 | 10% of the amount (between 500 and 20,000) |

| 3 | exceeds Rs.20,000 |

Rs. 1,950 plus 12% of the amount exceeding Rs. 20,000 for commercial consumers

Rs. 1,950 plus 5% of the amount exceeding Rs. 20,000 for industrial consumers |

- Update your scanned CNIC copy HERE

- Visit a KE Customer Care Centre with a copy of your valid CNIC and your KE Account Number.

- The KE Live App https://www.ke.com.pk/live-playstore (Google Play)

https://apps.apple.com/pk/app/ke-live/id1458106362 (App Store) - KE Live Web Portal https://live.ke.com.pk/Pages/LoginPage.aspx

The Change of Name process may take up to twenty (20) working days. You will receive a confirmation of completion via SMS. We will update your user account details on receipt of your complete request.

You can conveniently update the temporary address on your CNIC in the NADRA system via a simple process requiring nothing more than giving the temporary address as the card delivery point. This can be done both online or via a visit to a NADRA service centre.

Since a large proportion of our customers actively use WhatsApp for their regular communication, this platform was a natural extension for KE’s Customer Care Services as it is not only rapidly growing but is also familiar and comfortable for our users.

Scanning this QR Code

OR

Saving 0348-0000118 to your contact list and WhatsApping us a “Hi”

In case your KE account details are not registered against your phone number, you will be prompted for your KE account number.

- Get your Duplicate Bill and get information regarding bill payment options.

- Learn about your current Power Status and raise a complaint if needed.

- Lodge a billing complaint without visiting the Customer Care Centre

- View your load-shed schedule.

- Get your Income Tax certificate.

- Get guided about applying for a New connection.

Q3. Can elderly or differently abled persons avail bill installment or token bill from 118 helpline?

Q6. Can all commercial, residential and industrial customers avail these services from 118 helpline?

- Cardholder must have sufficient limit of funds the issued Credit/Debit card.

- On the duplicate bill page select “Payment Method”.

-

Enter complete cardholder details.

Full Name, Email, Mobile Number, Card number, CVV, Card Expiry Date, input OTP received on the registered mobile number or email. -

Verify & Pay

Verify payment details thoroughly. Click “Confirm and Pay” to complete the transaction.

Please note, KE does not charge any fees or charges over the Gross Amount Payable and any amount that might appear as additional deduction is the VAS charges for processing the transaction.

You can also visit our website www.ke.com.pk/power-shutdown-notices/ for the schedule.

For your ease, here is a quick link: www.ke.com.pk/power-shutdown-notices/ for the schedule.

This subsidy is applicable on industrial consumers having TOU tariff, falling into any of the following categories i.e., B1, B2 B3 B4 & B5.

Peak Rates are revised and are same as Off Peak, effective November 01, 2020 to April 30, 2021, further extended till June 2022.

The benefit of the subsidy was reflected starting from the December 2020 billing period of industrial consumers.

- Register online; simply click here and submit your 13 digit A/C # and mobile number.

- Register via SMS; type REG(space)[your 13 digit A/C #] and send this SMS to 8119.

Shortly after submitting your request, you will receive a welcome note that confirms your registration with the K-Electric mobile service.

These shutdowns and preventive maintenances are essential to ensure the system continues to operate at an optimum level.

Bills in addition to the monthly (regular) bill are called supplementary bills. These are charged to consumers for the following reasons:

- Units billed on account for consuming electricity through illegal means

- For any prior period, adjustments in accordance with the criteria specified in CSM for eg. Meter slowness etc.

- For the transition period when the tariff is changed from one category to another

Please note that as per Chapter 07 of the NEPRA Consumer Service Manual read together with the Tariff Terms and Conditions, the consumer shall, in no case use the connection for the purpose other than for which it was originally sanctioned. In case of violation, the consumer is liable for disconnection and legal action.

The phrase for the purpose other than for which the connection was originally sanctioned means if a connection was originally sanctioned under one tariff category for example domestic tariff (A-I) and is being used for commercial purpose i.e. A-2, KE shall serve seven days clear notice to the consumer who is found misusing his/her sanctioned tariff. However, KE shall immediately change the tariff and shall determine the difference of charges of the previous period of misuse to be recovered from consumer. However, in the absence of any documentary proof, the maximum period of such charges shall not be more than two billing cycles.

Please note that as per the Tariff Terms and Conditions, Residential Tariff (A1-R) is applicable for residences and places of worship whereas Commercial Tariff (A1-R) is applicable for supply to commercial offices and commercial establishments such as Shops, Hotel and restaurant, Petrol pumps and Service Stations, CNG filling stations, Private Hospitals/Clinic/Dispensaries, Places of Entertainment, Cinema Theater, Clubs, Guest Houses/Rest Houses, Office of Lawyers, Solicitors, Law Associates and Consultants , All private offices

Tariff Changes – May 22, 2019

Tariff Terms and Conditions for consumers of K-Electric Limited were modified by National Electric Power Regulatory Authority’s (NEPRA) in July 05, 2018 and notified in SRO # 576(I)/2019 dated May 22, 2019, issued by the Ministry of Energy (Power Division) which has been subsequently updated through SRO 1429(1)/2021 dated November 5, 2021.

Please refer here for latest terms and conditions

Tariff rates

Electricity tariff for K-Electric consumers was revised by Ministry of Energy (Power Division) through SRO 575(I)/2019 dated May 22, 2019, subsequently updated through SRO 1037 dated October 12, 2020 and SRO 192 dated February 12, 2021.

Further, Ministry of Energy (Power Division) updated consumer end tariff through SRO 1429(1)/2021 dated November 5, 2021.

Recently, Ministry of Energy (Power Division) has further updated consumer end tariff through SRO 1004(1)/2022 dated July 7, 2022.

Please click here for latest tariff rates

A) Time of Use Billing:

All Consumers having sanctioned load of 5 kW or above are eligible for Time of Use (ToU) billing and are being billed on consumption during peak hours and off-peak hours as mentioned below.

*To be duly adjusted in case of day light saving

B) Bank Charges and Meter Rent:

Bank charges and meter rent are no longer be charged to customers.

C) A3 Tariff:

A new A-3 General Services Tariff category was introduced. To find out which categories of customers this Tariff shall be applicable please refer Question 16

D) Lifeline Consumer:

The criteria for ‘Lifeline Consumers’ was changed. However, it has been further updated through SRO 1429(1)/2021 dated November 5, 2021. Please refer Question 15 for latest definition of lifeline consumers.

E) B1 & B2 Tariff:

The criteria for B1 Tariff was revised to include all Industrial consumers having sanctioned load of up to 25 kW. Whereas B2 Tariff will now be applicable on Industrial Consumers having sanctioned load between 25 kW to 500 kW.

- Test report issued by the Electric Inspector or his authorized wiring contractor

- Copy of last paid bill subject to the condition that no arrears/deferred amount/installments are pending.

- Attested copy of CNIC

- Signed Power Supply Contract can be obtained from KE offices

- Payment of Capital Cost (if applicable)

- Updating of Security Deposit in case of extension/reduction of load at prevailing rates subject to adjustment of already paid security deposit.

Please also note that in case of reduction of load, the Security Deposit shall be updated at prevailing rates and the difference of the Security Deposit shall be refunded/charged, as the case may be.

- Approved religious and charitable institutions

- Government and Semi-Government offices and Institutions

- Government Hospitals and Dispensaries

- Educational Institutions

- Water Supply scheme including water pumps and tube wells operating on three phase 400 volts other than those meant for irrigation or reclamation of Agriculture land

- Embassies and Consulate Generals

Tariff Changes – November 5, 2019

Further, slabs for un-protected category of consumers have also been updated. Please refer latest SRO 1004 dated July 7, 2022 for latest slab structure.

The lifeline consumers include residential Non-Time of Use (Non-ToU) consumers having maximum of last twelve months and current month’s consumption less than or equal to 100 units; two rates for less than or equal to 50 and less than or equal to 100 will continue.

– Under Phase I, definition of protected and unprotected consumers was introduced for residential consumers and slabs were further broken. As per MoE, this was done to ensure that the most vulnerable residential consumers are identified through electricity consumption so that they are fully or partially protected from any future price escalation

NEPRA approved these proposals on September 23, 2021 and were incorporated by MoE in tariff notification dated November 5, 2021.

– Under Phase II, it has been proposed to remove slab benefit from Un protected residential consumer. NEPRA has approved this proposal vide decision dated March 9, 2022 and MoE has notified the same within SRO 1004(1)/2022 dated July 7, 2022.

– Under Phase III, further reduction of subsidies is proposed, however, the same is yet to be announced.

When a consumer defaults in payment of his electricity bills for two months, he becomes eligible for disconnection. The KE team disconnects the consumer’s line tlll payment of the bill; the reconnection charges are included in the subsequent bill.

- Default

- Illegal utilisation of excess load

- Theft

- Using the electric connection for a purpose other than for which it was sanctioned

There are different scenarios under which the consumer can be charged estimated billing, including:

- Consumption of electricity while the line is disconnected

- Faulty meter

- Theft of electricity

You can also email newconnection@ke.com.pk

-

Taxation:

- For sales by KE to consumer: Taxes are applied on the gross units.

- For sales by consumer to KE:

For sales by consumer to KE [Export]: For export of electricity by Companies, there will be no withholding of sales tax or income tax withholding on adjustments/payments [Clause 46AA (VI) of Part IV of Second Schedule to the Income Tax Ordinance, 2001 read with Eleventh Schedule to the Sales Tax Act, 1990]

For export by consumer other than Companies, income tax withholding under Section 153(1)(a) of the Income Tax Ordinance, 2001 on adjustments/payments. No withholding of sales tax under the Eleventh Schedule to the Sales Tax Act, 1990.

- Sales by Consumer to KE:

- If unit sales by consumer is lower than sale by KE to consumer:

- Same rate/logic as of consumption from KE will be applied on the exported amount

- If unit sales by consumer is higher than sale by KE to consumer:

- On sales in excess of consumption units i.e. Units exported by consumer above the units consumed: Pre-determined National Average Purchase notified by NEPRA (National Electric Power Regulatory Authority) price will be applied

Currently, NAPP is PKR 19.32 / kWh as per NEPRA’s decision dated June 02, 2022.

Please refer Net Metering regulations (last para of SRO 1135(I)/2018) for applicability of NAPP and NEPRA’s decision for for HESCO dated June 02 , 2022 (para 7.29) for NAPP of PKR 19.32/kWh,

- If unit sales by consumer is lower than sale by KE to consumer:

Befiler is Pakistan’s number one online tax filing and NTN registration portal for individuals and SMEs.

All new customers who download KE Live App will get a maximum 50% discount on their first Foodpanda order (capped at PKR 500).

Terms & Conditions

- This offer is applicable upon new KE Live App download and new customer of Foodpanda.

- Minimum order value – PKR 150.

- Applicable across Foodpanda except Pandamart.

- Voucher validity – 3 months.

- These vouchers will be sent to customers by KE through SMS and or Email.

- In case of queries related to FoodPanda, kindly reach out to their help center on the app

Befiler

All new customers who download the KE Live App can avail 87% off on NTN registration and Tax filing. The customers will only need to pay PKR 500/- to avail Befiler services.

Terms & Conditions

- Upon KE Live App download, vouchers will be sent to customers by KE through SMS and or Email.

- Multiple individuals can register, and avail offer against one account number.

- In case of queries related to Befiler please contact 021-38892069